In a strategic push to fortify the U.S. semiconductor industry, the Biden administration is set to inject billions into key players, ushering in a new era for advanced microchip production. This bold initiative is a crucial component of the $53 billion Chips Act. Its primary goal is to revitalize domestic manufacturing and effectively respond to China’s rapid advancements in the semiconductor sector.

Delays Fuel Frustration

Despite the bipartisan 2022 law’s aspirations, delays in implementation have fueled frustration among over 170 applicant firms. While only two grants for less advanced chips have been awarded, insiders within the industry suggest that there are imminent announcements on the horizon. These announcements may involve substantially larger sums, potentially reaching into the billions.

Strategic Timing

Anticipation builds as the announcements align strategically with President Biden’s State of the Union address on March 7. The President aims to spotlight economic achievements amidst a burgeoning presidential campaign, where former President Donald Trump leads the Republican nomination race.

Pressure Mounts

Acknowledging the urgency, industry experts recognize the pressure to fund major players before the political landscape intensifies. However, concerns loom over potential delays stemming from permitting and environmental reviews, raising questions about the timeline for taxpayer-subsidized factories producing American-made chips.

Leading Contenders

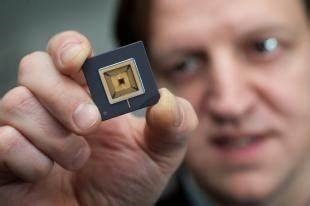

Intel takes the spotlight with projects spanning multiple states, totaling over $43.5 billion. TSMC, constructing two fabrication plants near Phoenix at a cost of $40 billion, also stands as a key contender. Other major players, including Samsung Electronics, Micron Technology, Texas Instruments, and GlobalFoundries, are in the race, according to industry insiders.

Confidence Amid Uncertainty

According to a Wall Street Journal report, while Michael Schmidt, director of the Chips Program Office, expresses confidence in significant progress this year, the industry remains cautious. Uncertainty over the National Environmental Policy Act (NEPA) could extend construction timelines, adding complexity to an already intricate process.

Legislative Hurdles

According to The Washington Post, efforts to exempt major Chips Act projects from NEPA review face hurdles in the House, sparking debates on broader permitting overhauls and environmental standards. Negotiations face additional complexity due to a lack of clarity on program rules. Some industry executives have expressed dissatisfaction with the current offerings.

Workforce Shortages Loom

The shortage of skilled workers in the semiconductor industry emerges as a potential cause for delays. With estimates indicating a projected shortfall of 67,000 workers by 2030, industry experts stress the importance of predictability. They emphasize that fostering a stable environment is crucial to encouraging substantial investments, ultimately ensuring competitiveness in the global market.